J.B. WOOD THOMAS LAH

Chapter

Nine

Preview

The Case for

Managed Services

(Final chapter may vary.)

TECHNOLOGY-AS-A-SERVICE  PLAYBOOK

PLAYBOOK

How to Grow a Pro table

Subscription Business

2 Technology-as-a-Service Playbook

Before You Begin

Dear Reader,

The cloud is radically reshaping how technology gets sold and consumed.

Perhaps more importantly, it is shaking up the tech business model.

For all of its many virtues, the cloud business model has yet to emerge as a reliably profitable one. Even pure-play SaaS companies that have been in the game for a decade or more have yet to consistently deliver GAAP profits. That slows traditional tech companies from pivoting their business and opens the door for them to be disrupted by new entrants.

At TSIA, we believe that subscription-based business models like SaaS and managed services can be very profitable. And we think a blueprint for how to build a sustainably profitable technology-as-as-service (XaaS) business is emerging. And so we have written a new book, Technology-as-a-Service Playbook: How to Grow a Profitable Subscription Business.

While the final publication is not due until Spring 2016, we are sharing a look at one of the chapters to begin a dialog around this important topic. We know we are treading on some controversial ground but believe that our industry must move more quickly to marry the many benefits of the cloud to a profit-able business model. This book offers a framework and specific plays for how to do that.

We invite your comments and request that they be directed to:

Thank you for taking the time to review this material. We eagerly await your feedback.

Best regards,

J.B. Wood, Co-Author

President & CEO, TSIA

Thomas Lah, Co-Author

Executive Director, TSIA

| Table of Contents | 3 |

Table of Contents

The Big Picture – helpful reading for everyone Chapter 1: Disruption Happens

Chapter 2: The 3 X 3 of XaaS

Chapter 3: Digging Economic Moats For Your XaaS Business

Chapter 4: Stressing Traditional Organizational Structures

Chapter 5: Swallowing the Fish

The Tactics – read what you care about Chapter 6: The Power of XaaS Portfolios Chapter 7: XaaS Customer Engagement Models Chapter 8: The Financial Keys of XaaS Chapter 9: The Case for Managed Services

Chapter 10: Changes in the Channel Epilogue

![]()

- The Case for Managed Services

This book is about conducting successful XaaS offers. For com-panies that have been selling technology as an asset, the pivot to selling technology as a service can be overwhelming. The many things to consider and worry about can make this seem like a bridge too far. But, a first step that traditional technology com-panies can take on this journey to help them ease into the XaaS marketplace is to stand up a managed services capability.

In this chapter, we’ll explore the special case of managed ser-vices (MS) as entrée into XaaS. For the past several years, we have been aggressively studying and benchmarking how enterprise tech companies of all sorts are incubating and growing MS businesses. So, let’s discuss the pros and woes of how, why, and when to build your MS offer. Specifically, we will cover the following ground:

- The explosion of managed service revenues.

- Trends driving managed services.

- The many flavors of managed services.

- Why product companies fear managed services.

- Why companies should embrace managed service opportunities.

- Success tactics when incubating managed service capabilities.

2 Technology-as-a-Service Playbook

By the end of this chapter, management teams should clearly under-stand why managed services is the fastest growing service line in the technology industry and why this opportunity shouldn’t be ignored.

The Explosion of Managed Services

We benchmark the overall revenue mix of technology companies at a level of detail not available in the standard 10-K. One of our objectives with this data is to clearly understand how the eco-nomic engines of technology companies are changing over time. MS revenues have been present in the industry for years. In 2013, our data showed that 23% of the companies we benchmarked had some type of MS revenue stream. By the end of 2015, 46% of companies were reporting an MS revenue stream. That is a dou-bling of MS offers in just two years.

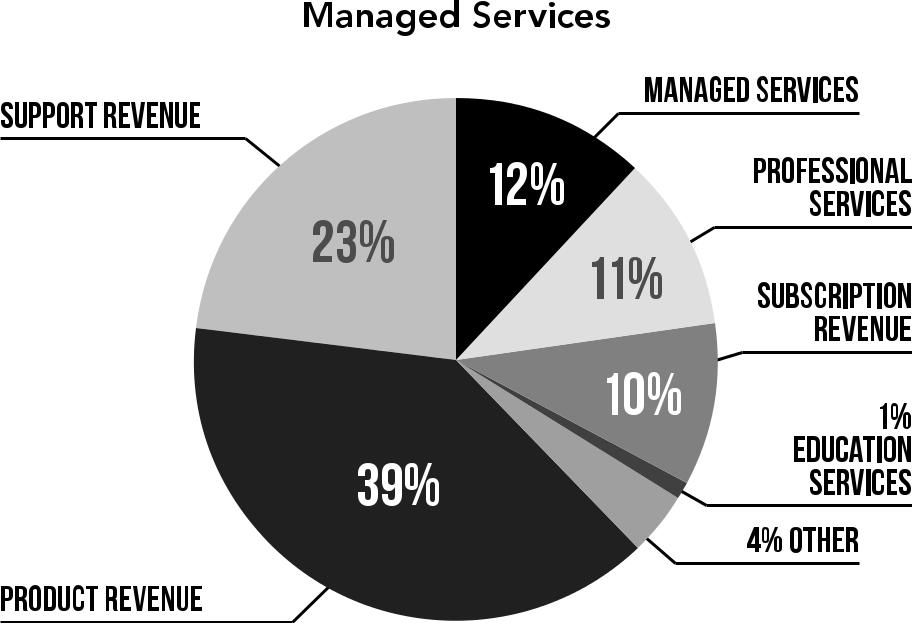

Not only are more companies jumping into MS, but MS is also starting to become meaningful revenue. The average revenue mix for companies that benchmark their managed services busi-ness with TSIA indicates that MS has blossomed to 12% of total company revenues, as seen in Figure 9.1.

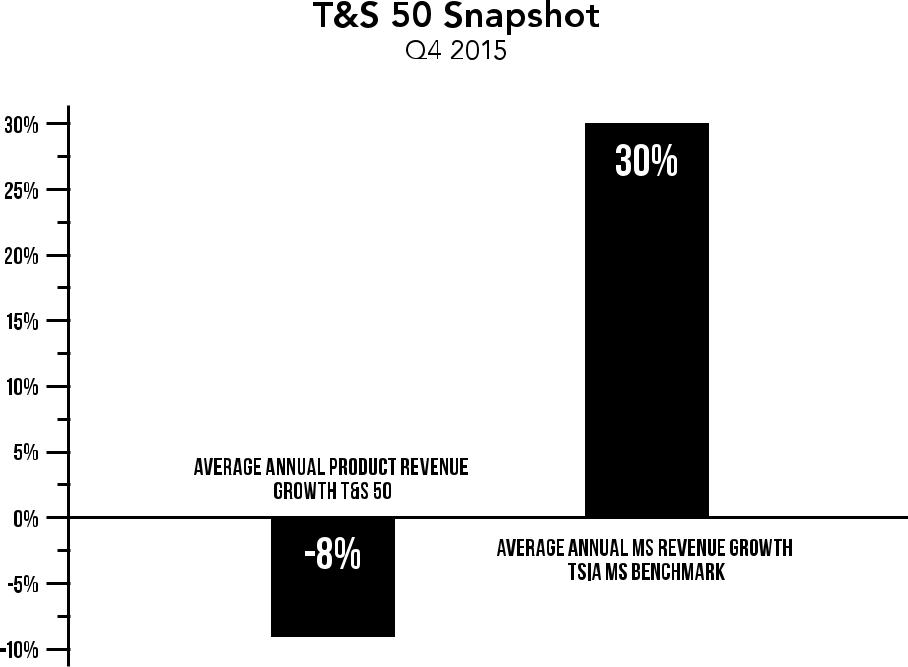

More importantly, the average annual growth rate of these MS revenues exceeds 30%. This growth rate is far outpacing the aver-age growth rate for product revenues we see in the industry today. In our last T&S 50 snapshot of 2015, product revenues, on average, were shrinking 8%! (See Figure 9.2.)

Finally, MS revenue streams are proving more and more prof-itable. The TSIA MS benchmark reports average MS gross mar-gins greater than 40%. Some MS providers are generating gross margins just slightly south of 70%. In our annual survey on overall organizational structure, we ask technology companies to simply report the general profitability profile of every service line they have, the results of which are seen in Figure 9.3. For the past two years, MS has been reported as the second most profitable service activity, right after highly lucrative support services.

| The Case for Managed Services | 3 |

FIGURE 9.1 Revenue Mix for Companies that Benchmark MS

FIGURE 9.2 MS Revenue Annual Growth Rate

4 Technology-as-a-Service Playbook

Which best describes the financial performance of the following service lines for the most recent fiscal year?

| 100% | |||||||||||||||||

| 43% | 41% | 36% | 18% | ||||||||||||||

| 80% | 55% | 45% | |||||||||||||||

| 60% | |||||||||||||||||

| 40% | |||||||||||||||||

| 20% | |||||||||||||||||

| 0% | |||||||||||||||||

| CUSTOMER | MANAGED | FIELD | CONSULTING | TECHNICAL | EDUCATION | ||||||||||||

| SUPPORT | SERVICES | SERVICES | SERVICES | SERVICES | SERVICES | ||||||||||||

(CUSTOMER AND/OR

PARTNER TRAINING)

Highly Profitable (20% net OI or greater)

Profitable (5%-19% net OI)

Break-Even (0% net OI, +/-5%)

Unprofitable (-5% net OI or less)

FIGURE 9.3 Profitability of Service Lines

So, MS is undoubtedly a rising star in the economic engine of technology companies. But why?

Trends Driving Managed Services

Multiple trends are driving the demand for managed services. Many of these trends were heavily discussed in our last two books, but let’s do a quick review:

- Reducing Operational Complexity. Customers no lon-ger want the headaches of running IT operations, especially if they don’t view this as a core competency of the company.

- On-Demand Capacity. Customers don’t want to pay for IT capacity they don’t need. MS models are much more flexible and allow the customer to buy capacity as required.

| The Case for Managed Services | 5 |

- OpEx versus CapEx. Some customers (clearly not all) have a preference for spending operating dollars and not capital dollars when it comes to technology. CapEx leads to having big, lump-sum payments and then owning assets that must be depreciated over time. Migrating IT expenses to OpEx typi-cally leads to smoother, more predictable expenses over time.

- Value Beyond Technology. Customers look for technology providers to apply unique insights to help maximize the busi-ness impact of technology. One common value proposition is MS offers that feature accelerated technology adoption versus do-it-yourself tech.

- Economies of Scale. Technology providers can create en-vironments, tools, and processes that support multiple cus-tomers. These economies should allow providers to deliver technology environments more cost effectively than custom-ers can create as a one-off.

- Strategic versus Tactical. CIO magazine published an ar-ticle citing the growing demand for managed services. The magazine reported that CIOs are interested in leveraging out-side vendors to manage day-to-day operations so internal IT staff can focus on strategic initiatives.1

Generically, TSIA sees these trends resulting in five common MS offering value propositions, listed below and seen in Figure 9.4.

- Monitor. Monitor technology availability and performance for the customer.

- Operate. Operate the technical environment on behalf of the customer.

- Optimize. Work with the customer to optimize technology costs, improve technology adoption, and maximize the busi-ness impact of the technology.

- Transform. Help the customer implement and integrate a new set of technology capabilities.

6 Technology-as-a-Service Playbook

![]()

![]()

![]()

FIGURE 9.4 Common MS Offering Value Propositions

- Managed XaaS. Technology may be on site, hosted, or a hy-brid of the two. The solution is typically comprised of product (hardware and/or software), professional services, support, and operations elements bundled into a single per-unit, per-month price governed by a managed services agreement. Hardware and/or software is owned by the managed service provider.

Importantly, current and future generations of MS don’t look anything like the low-margin outsourcing businesses of the past. Ideally, services are cloud-enabled, delivered from a remote net-work operations center. Delivery resources are typically shared across multiple clients. The product elements within the MS offer may be hosted and/or on premises; they may be single tenant or multi-tenant.

In September 2015, Forbes cited a study that more than half of IT managers expect to use multiple managed service providers (MSPs) within the next two years; a whopping 85% are at least somewhat likely to use MSPs.2

So, if you have a customer who is demanding one of the MS value propositions previously cited and you don’t have an offer, you may lose that customer. How many customers can you afford to lose until you bring an MS offer to market that the market clearly wants?

| The Case for Managed Services | 7 |

The Many Flavors of Managed Services

Before you decide whether your company should pursue an MS business, it is important to segment the different types of MS businesses. TSIA segments MS offers based on the following five questions:

- Is the offer standard across many customers or unique for each customer (as defined in Chapter 6 on portfolio power)?

- Is the value proposition differentiated (again, referring to Chapter 6)?

- Regardless, whether the technology is on site or not, can the services be delivered off site (virtually)?

- What are the specific value propositions of the offer as defined by TSIA’s five classic value propositions for MS offers?

- Does the MS provider own the technology assets under management, or does the customer own the assets?

So, let’s map two different example offers:

- Off-Site Monitoring. The customer would like you to monitor technology that’s been purchased from your company. You have unique capabilities to deliver this monitoring remotely.

- On-Site Operation. The customer wants the technol-ogy to be present on their site, but they don’t want to manage the environment. You need to provide some on-site services to manage their environment. Also, they do not want to own the technology.

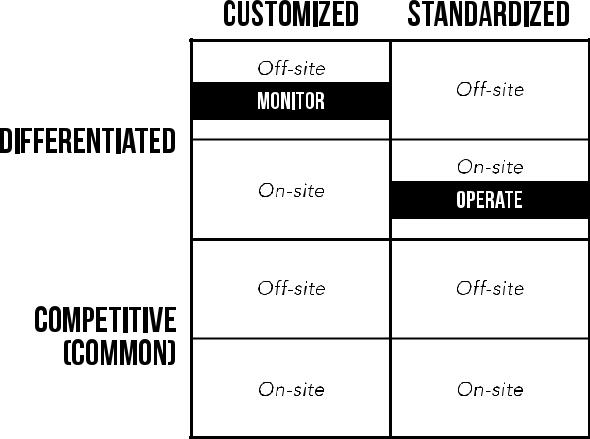

Figure 9.5 maps these two offerings on our offering grid. The grid has been further segmented to show whether an offer is being delivered on site or off site. A solid line around the offer

8 Technology-as-a-Service Playbook

means the MSP owns the technology assets. A dotted line around the offer means the customer owns the technology assets.

FIGURE 9.5 Offering Grid A

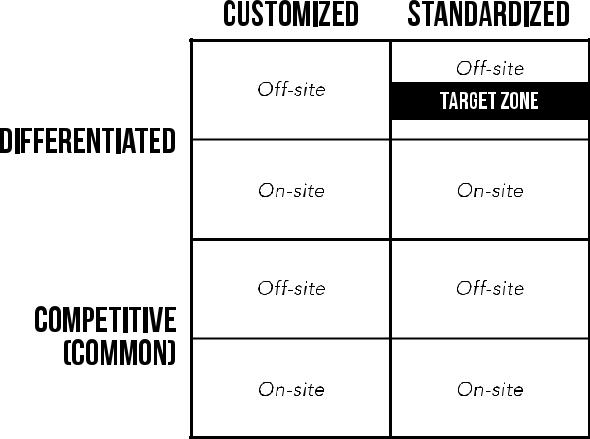

The question quickly becomes, “What are the high-growth and profitable MS offers?” This is exactly what we have been studying since 2013. There is no doubt that standard, off-site of-fers, where the customer owns the asset, have the greatest poten-tial to drive the highest MS margins with the least financial risk to the provider (Figure 9.6).

Breaking our benchmark data down into more detail, here are the highest-to-lowest margin MS offer types:

FIGURE 9.6 Offering Grid B

| The Case for Managed Services | 9 |

- Customer premised, customer owned, remotely monitored.

- Customer premised, customer owned, remotely operated.

- Hosted, customer owned, remotely monitored.

- Hosted, customer owned, remotely operated.

- Hosted, provider owned and operated.

Also, the data clearly shows that standard offers are more profit-able than custom offers. On average, there is a nine-point profit improvement if an MS offer can be standardized across customers.

Unfortunately, we see that customers often start MS conversa-tions with a host of custom requests. In fact, many of these offers are actually created “in the field” to meet the needs of specific deals. That is not the right way to approach your MS business. In-stead, it reflects a common scenario where headquarters are hesi-tant about launching an MS business when their customers clearly want it. So, rather than lose the deal and the customer, sales makes one up. In some of these early deals, customers are often interested in the provider owning the assets.

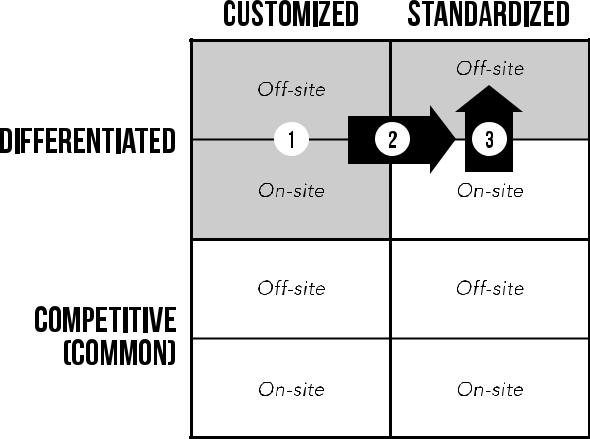

Here’s a better way: To accommodate early customer requests, successful MSPs are making three moves on the offer chessboard, listed here and seen in Figure 9.7.

- First Move. Work with strategic customers to define a dif-ferentiated MS offer. You can lean toward customers owning the assets, but you may need to be flexible. Perhaps you can arrange for a third party to carry the paper on the assets while you provide the managed service. Begin signing MS contracts.

- Second Move. Begin identifying the common building blocks of customer needs. Create a “standard” set of LEGO® building-block MS capabilities customers can string together into an offer that meets their needs.

- Third Move. Maximize every opportunity to leverage tech-nology and off-site labor to deliver the offer.

10 Technology-as-a-Service Playbook

FIGURE 9.7 MS Offer: Preferred Method

So far, we have talked about the compelling and special case of MS in the enterprise tech business circa 2016. We have helped define the drivers for MS offers. We have also helped define the different types of MS offers and how technology providers are successfully maturing their MS offers. Despite this help that we regularly offer to members, though, we still see many traditional product companies incredibly resistant to exploring MS conversa-tions with eager customers. Why?

Why Product-Centric Companies Say No to Managed Services

George Humphrey, vice president of research for the Managed Services practice at TSIA, refers to this dilemma as “the battle of the CFOs.” In one corner, we have the customer CFO. In their role, they are keen to acquire some of the benefits listed earlier— reduced operational costs, predictable IT costs, and improved ROI from technology investments. In the other corner sits the technol-ogy provider CFO. Their role is to protect the financial business model. They are extremely reticent to sign off on any offers that may increase company risk, reduce cash flow, or impact the mar-gin profile of the company. The customer is asking for managed

| The Case for Managed Services | 11 |

services, but the CFO and other executives at your company are quick to raise the following concerns:

- We don’t own customer assets. When negotiating MS deals, customers may not want to purchase the technology assets being managed. This means the provider has to carry the cost of these assets on their books. CFOs may be loath to carry these expenses on the company balance sheet.

- Delayed revenue recognition. If the customer is not paying for the assets up front, that means the revenue for this tech-nology will trickle in as part of a long-term service contract. Not ideal! We are a product company—we recognize product revenue, and we recognize it as soon as legally possible!

- Service revenue intensive. These MS deals are going to increase service revenues and decrease product revenues. Our financial model indicates how much revenue should be com-ing from products versus services. We will start looking like a services company to the street—which is not what we his-torically said we were.

- Increased risk. When we sell technology assets, the customer is ultimately responsible for achieving their target business re-sults. With these MS contracts, we are taking on increased re-sponsibilities. We are introducing new risks to the business. We may fail to meet contract SLAs and pay penalty clauses. The customer may be dissatisfied and cancel halfway through the contract. We might make an error in the customer environ-ment and be sued.

- Channel conflict. Other executives beyond the CFO and CEO will start chiming in with their concerns. The execu-tive who owns channel partners will be concerned that new MS offers conflict with partner offers. “We are stealing the bread from our partners’ mouths. They will jump to selling the product of our competitors.”

12 Technology-as-a-Service Playbook

- Complex sales cycle. The sales executive may have con-cerns about the ability of sales reps to sell these complex MS offers. Also, by introducing an MS option, the customer selling cycle will most likely elongate—which is death to a sales force driven to close deals as quickly as possible and collect the cash.

- Smells like outsourcing. In the end, isn’t MS really just another word for outsourcing? And isn’t outsourcing one of the lowest-margin businesses in the technology industry?

The concerns and objections mount among executives, so there may be many reasons not to pursue this business. Yet, our point of view is that product companies should absolutely be pursuing MS opportunities when strategic customers begin knocking on the door for these services.

Just Say Yes

Despite the concerns listed here, we believe product companies should aggressively assess their opportunity to provide managed services for the following five reasons:

- There is a compelling market opportunity for managed services.

- Managed services is not IT outsourcing.

- Managed services is an effective short-term defense against new XaaS competitors.

- MS offers force the creation of new capabilities required to compete in the XaaS economy.

- You could lose customer, after customer, after customer.

As cited previously in this book, market research firm Gartner signaled that worldwide IT spending was actually shrinking by 5.5% in 2015.3 This opinion correlates with what we see in our T&S 50 data as we track the largest providers of technology solu-tions on the planet.Yet, the managed services market opportunity

| The Case for Managed Services | 13 |

is exploding. Research firm MarketsandMarkets forecasts that the managed services market will grow from $107.17 billion in 2014 to $193.34 billion by 2019, at a compound annual growth rate of 12.5%.4 For technology companies looking for growth, managed services becomes a compelling market opportunity.

Today’s MS offers are not like yesterday’s outsourcing offers. The traditional value proposition of IT outsourcing was simple: your mess for less. Outsourcers focused on cost reduction. As out-sourcing became more competitive, margins for outsource pro-viders eroded. But today’s MS offers from product companies are anchored on unique capabilities designed to unlock the full po-tential of a technology solution. Benefits go beyond cost reduction into other areas, such as revenue growth and risk reduction. Also, MS offers can be much more targeted to specific technologies or problem sets. Product companies are not asking to take over the entire IT operation for a customer. We are seeing an explosion of product companies wrapping a managed XaaS offer around their core products. This offer is creating differentiation in the mar-ketplace when contrasted with product companies that are only interested in selling a product to the customer and then leaving. With your MS offer, you create value far beyond commoditized technical features by reducing total operational complexity.

When it comes to financial concerns about asset risk and revenue recognition, many manufacturers successfully use third-party financing to give customers more of the OpEx price model they crave without all the negative baggage. It helps them:

- Minimize the financial risk of carrying infrastructure costs on their books. This tends to affect valuation for traditional companies.

- Get immediate revenue recognition on the product portion of the deal.

Be aware, though, that many financial auditing firms will tell you that you still have to recognize the revenue on the product over

14 Technology-as-a-Service Playbook

the duration of the service contract because the “value” of the product is directly linked to and inseparable from the value of the service. Service providers, VARs, and system integrators don’t want the financial risk and burden of carrying all those assets on their books.

Cloud providers are somewhat exempt from all of this be-cause, from day one, they embrace this business model. They know all revenue is recognized over the duration of the contract. They know there are inevitable costs of service that are asset and infrastructure based. Cloud investors also understand this. Manu-facturer investors don’t.

In the book Zone toWin, our friend Geoffrey Moore discusses the importance of playing defense during significant market trans-formations. When entrenched market leaders are threatened by new offer types that disrupt the status quo, the recommendation is to respond with offers that slow competitive disruption. These “neutralization” offers don’t have to go toe-to-toe against the new competitors. These defensive offers simply need to provide some new options to existing customers that may delay their choice to jump to the competitive offers. MS offers for entrenched product companies are a classic example of a neutralization offer. A large and strategic customer that previously purchased technology assets from you is now asking for a XaaS option.You meet them halfway with a special MS offer. The MS contract keeps the customer on your books and creates runway for you to develop a XaaS offer.

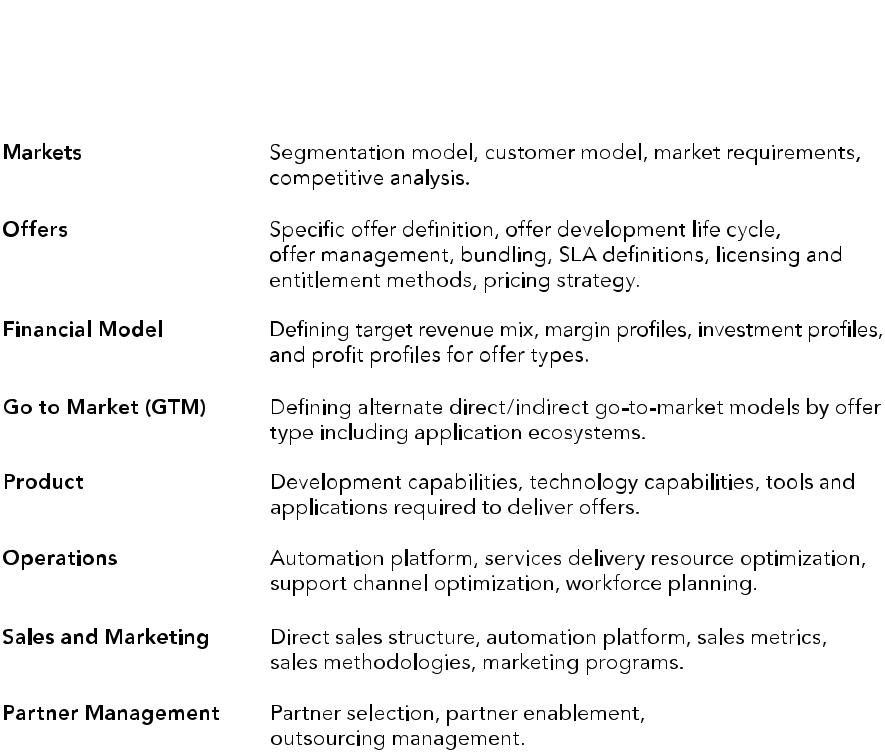

Finally, establishing MS offers is a forcing function for de-veloping new organizational capabilities that will be required to compete in the XaaS economy. In our work at TSIA, we define and track “organizational capabilities.” We define organizational capabilities as “the ability to perform actions that achieve de-sired results.” We organize the capabilities into the nine categories shown in Figure 9.8.

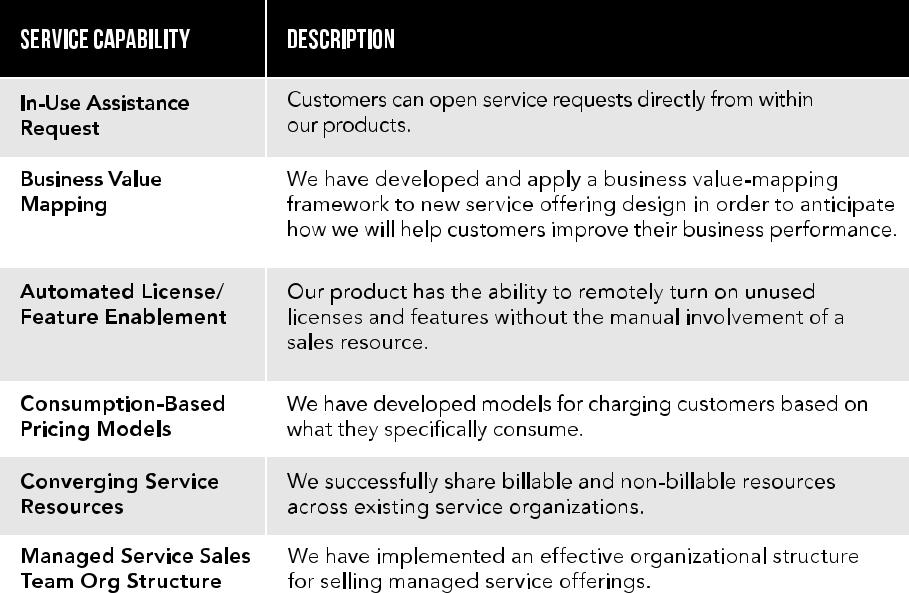

In each of these categories, there are capabilities that organiza-tions must master in order to scale and optimize their MS business.

| The Case for Managed Services | 15 | ||||

FIGURE 9.8 Organizational Capabilities Categories

As previously mentioned, taking on MS deals typically requires product companies to develop new organizational capabilities. As an example, sales and finance must collaborate on new pricing, revenue recognition, and compensation models. Delivering MS offers will require the services organization to build capabilities related to monitoring customer environments, driving adoption, and helping customers optimize costs. Overall, we have identified more than 100 capabilities required to master a managed services business but are relatively immature in most product companies. Figure 9.9 provides a sampling of these emerging capabilities.

Ideally, you would build out all the capabilities in our ca-pabilities inventory before you take on your first MS customer. But more typically, by piloting new MS offers, product compa-nies begin the journey of developing these new capabilities. All of

16 Technology-as-a-Service Playbook

FIGURE 9.9 Example Emerging Capabilities Required for MS

these emerging capabilities will serve a product company well as customers pull them into the new XaaS economy.

Picking the Right Customers

Although we are encouraging product companies to aggressively pursue emerging MS opportunities, we do not believe all oppor-tunities are created equally. One of the significant concerns execu-tives have regarding the additional risk being assumed in MS deals can be summarized in one sentence: “What if the customer doesn’t do what they need to do to achieve the target outcomes of the MS contract?”

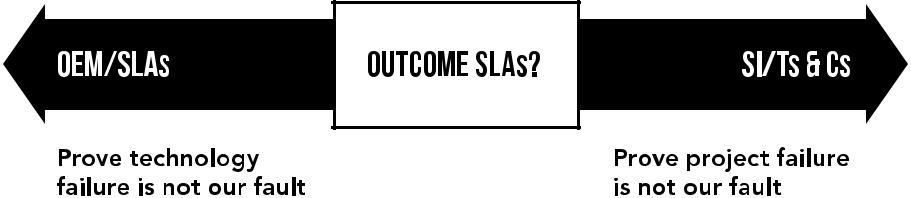

This is a real concern and a healthy question to ask. The intu-ition is to solve this challenge contractually—to design contracts that hold customers accountable to deliver their end of the deal. When you look into the technology industry today, you’ll find two common types of service contracts: (1) contracts crafted by technology providers that are centered on meeting service level agreements, and (2) contracts crafted by system integrators that cover large, complex technology implementations. Figure 9.10 captures these two contract examples.

| The Case for Managed Services | 17 | ||

![]()

FIGURE 9.10 Common Service Contract Types

The purposes of these two contract types are different. SLA-based contracts are designed to meet customer expectations re-garding technology availability. From the provider’s perspective, these contracts minimize risk when technology goes down if the provider has been meeting all of their SLAs. Product companies are very familiar and comfortable with these types of contracts. SI contracts centered on detailed terms and conditions are designed to minimize risk if an implementation project fails. As shown in Figure 9.11, neither of these contract types really fit the bill for

![]()

FIGURE 9.11 Missing Outcome-Based Contracts

18 Technology-as-a-Service Playbook

creating a contract that is designed to create an MS partnership with the customer to achieve targeted business outcomes.

When first exploring MS contracts that are designed to achieve specific business outcomes, we believe that attempting to craft a detailed contract that will drive customers to execute their side of the activities is not time well spent. Successful managed service relationships are not achieved through contracts. Initial MS success will be achieved by working with the right customers.

The recommended tactic when incubating MS is to identify the attributes required in a customer to make them a viable can-didate for an MS offer. There are at least four attributes we believe a provider should test for before attempting an MS relationship with a customer:

- Do senior customer executives view you as a strate-gic provider? If you spend your time with procurement or mid-level IT managers, it is not likely you will be able to influence the customer to execute the practices required to achieve a target outcome. Even worse, great progress and measurable results may not lead to increased customer spending.

- Does the customer have a history of listening to your recommendations? If not, an MS relationship is high risk. Why will they start listening now?

- Has the customer demonstrated reasonable project management and IT governance capabilities? If not, this customer will struggle to work with you to implement the technology and practices required to achieve targeted outcomes.

- Do you have the ability to benchmark the customer’s current performance on targeted KPIs? If the customer refuses to share data or does not have the ability to generate the data, this is a significant red flag. How can you improve performance KPIs if you do not know the current starting point?

| The Case for Managed Services | 19 |

This list is just a starting point. Technology providers should build on it to create a comprehensive set of customer attributes that should exist before engaging in an MS relationship. This ap-proach will minimize the risk that a customer will not do what they need to do. It is worth mentioning that profiling your MS customers is an ongoing effort. Well-structured deals that look profitable when being assembled may take a turn for the worse during the life of the contract. Continually measuring MS per-formance is crucial.

For decades, customers have qualified suppliers to ensure a good fit. When it comes to taking on more responsibility in achieving customer outcomes, suppliers need to qualify custom-ers. Ongoing, focused client management allows you to “fire” (not renew) non-profitable deals and to double down on customers that are profitable and growing. This new approach will not come naturally to many sales reps that historically viewed any customer with a budget as an eligible prospect. If you are simply selling a technology asset to a customer who then assumes responsibility for getting benefit from it, that tactic is fine. But if you are relying on customers to successfully adopt or attain specific business out-comes from your technology in order to achieve your revenue or margin goals, you must qualify their willingness and readiness to take the necessary actions. No contract, no matter how detailed, will replace the need for applying a solid customer profile tactic.

Incubating Managed Services: Key Success Tactics When incubating an MS business, the first three questions that must be answered are the same as those for any other XaaS offer:

- What is the offer portfolio and pricing model, and who are we selling it to?

- What is the customer engagement model that we will use to sell and deliver this offer?

- What are the financial keys that will allow us to make money with this offer?

20 Technology-as-a-Service Playbook

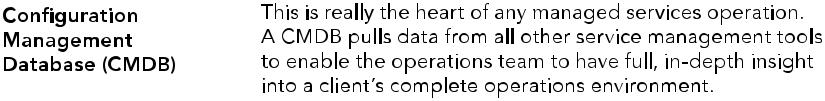

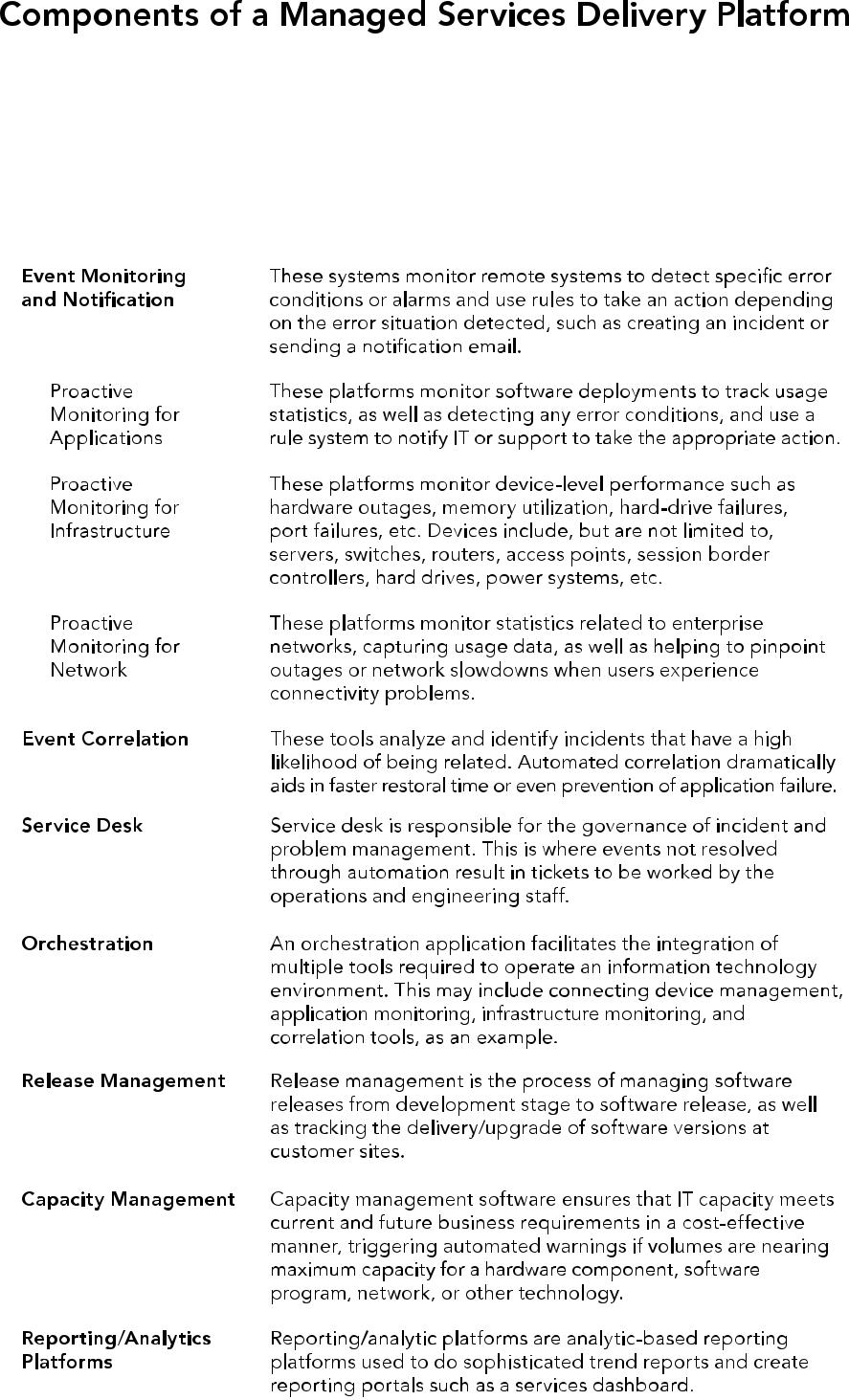

The TSIA Managed Services discipline engages with product companies to help them establish or optimize their MS businesses. Through that work, we have identified a set of success tactics to consider as you explore MS opportunities with your customers:

- Make finance your friend. If your finance group is not on board with pursuing MS offers, there is a high probability that the MS business will quickly atrophy from a lack of approved contracts. Finance needs to believe in this business, and they need to understand the financial models of MS.

- Understand the net-new capabilities that will be re-quired to successfully deliver an MS offer. MS offers do require you to be intimately involved in IT operational prac-tices. Common customer handshakes that must be mastered include applications management, capacity management, in-formation security management, and release management. Mastering these processes will most likely require new orga-nizational capabilities for your company.

- Understand the new sales skills that will be required to land MS offers. Our benchmark data is clear on this point. The existing product sales force will struggle with this offer. Yet, we know from our data that the most common approach is to attempt to sell new MS offers through the existing sales force. Our recommendation is to incubate a dedicated sales capability that specializes in selling MS offers. In TSIA bench-mark data, we see that companies relying on their existing sales force to sell MS are seeing annual MS growth rates of 5%. Companies that invest in a dedicated MS sales force are seeing annual MS revenues grow an average of 39%. Also, dedicated MS sales reps secure deals that are almost 20% more profitable then the deals being sold by generalist sales reps.

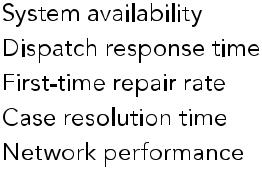

- Establish key performance indicators and measure them regularly. One of the surprising facts we discovered is how many product companies have established MS offers with no clear definition of the KPIs that should be used to

| The Case for Managed Services | 21 |

understand the health of an MS offer. If they did have KPIs, they often had no idea what “good” should look like for that KPI. This is not untrodden ground. The technology indus-try understands what metrics to measure related to MS. In addition, we have specific benchmarks on what pacesetting companies achieve on these metrics. Figure 9.12 provides a sampling of the KPIs we recommend MS organizations track.

FIGURE 9.12 Top 10 Metrics MSPs Should Be Tracking

22 Technology-as-a-Service Playbook

- Pilot, pilot, pilot. As previously mentioned, it is very im-portant to identify the right customers for your MS offers. Not all customers are good candidates for this type of rela-tionship. Once you start identifying customers, the initial MS engagements should be approached as pilots designed to help you mature the offer. It is unlikely your first MS offer will spring from the heads of your offer designers fully formed. Early customers should understand you are partnering with them to help define the best offer possible for both sides.

- Invest in automation early. The most profitable MS orga-nizations we benchmark have implemented commercial, off-the-shelf tools and platforms to help automate aspects of their MS operations. Key tools can be seen in Figure 9.13.

- Don’t ignore the channel. There is no doubt that when a product company decides to work with customers directly as a provider of managed services, channel partners get nervous. However, our point of view is that MS offers actually unlock an entirely new class of service opportunities for your part-ners as well. We will discuss this more in Chapter 10.

Summary Comments

Product companies, historically, have resisted building service ca-pabilities that are not directly related to installing and supporting their own products. However, we are at an interesting juncture in the history of the technology industry. We sit at an inflection point where old business models collapse and new business mod-els emerge. Managed services represents a unique opportunity for product companies to start navigating through this inflection point. There is clearly a market appetite for these services. There is solid evidence product companies can be very successful with these services. If you are not currently investigating MS offers, we strongly recommend you revisit that decision.

| The Case for Managed Services | 23 | ||||

FIGURE 9.13 Components of a Managed Services Delivery Platform

![]() 24 Technology-as-a-Service Playbook

24 Technology-as-a-Service Playbook

Playbook Summary

Two plays are identified in this chapter:

Play: Saying “YES” to MS

Objective: Determine whether the company should explore MS offers.

Benefits:

- Itemizes the industry trends driving the explosion of MS revenues.

- Itemizes key success tactics the company will follow to mini-mize risk when incubating MS.

Players (who runs this play?): Core players: CEO, CFO, head of marketing, head of services, head of product development.

Play: MS Opportunity Map

Objective: Identify potential opportunities the company has for MS offers.

Benefits:

- Creates a common taxonomy for the types of MS offers the company could pursue.

- Creates an understanding of what types of MS offers are the most profitable.

Players (who runs this play?): Core players: product de-velopment, product marketing, services marketing. Review team: CEO, CFO, sales and services leadership.

| Like What You’ve Read? | 1 |

| 01 | 6 | ||||

| 2 | |||||

| O | • | ||||

| G | |||||

| IE | |||||

| D | |||||

| N | |||||

| A | |||||

| S | |||||

Tech as a Service

Winning in the Cloud

Like What You’ve Read?

Join us at the TSW San Diego conference on May 2-4, 2016 where the complete book will be released and shared in keynote presentations by the authors.

Visit www.technologyservicesworld.com

The Technology Services Industry Association (TSIA) helps technology and services organizations both large and small grow and advance by providing world-class business frameworks, best practices based on real-world results, detailed performance benchmarking, exceptional peer networking opportunities, and high-profile certification and awards programs.

© Technology Services Industry Association

17065 Camino San Bernardo, Ste. 200 | San Diego, CA 92127 | Tel. 1.858.674.5491