FirstBlood

A Decentralized eSports Platform Based on Smart Contracts

Marco Cuesta, Zack Coburn, Anik Dang, Joe Zhou

Draft Version 0.1.5 August 2016

This document is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities in FirstBlood or any related or associated company. Any such offer or solicitation will be made only by means of a confidential offering memorandum and in accordance with the terms of all applicable securities and other laws.

- FirstBlood

- Abstract

- Autonomous

- Decentralized

- Fully Automated

- Market

- A third of fans don’t just want to watch eSports, they also want to compete.8

- Opportunity

- Potential platform volume based on current data

- The Solution

- Future Vision

- Licensing

- App Token

- Token Acquisition

- Token Presale

- Playing Matches

- Match Result Verification

- Witnesses

- Jury Voting Pool

- Sybil Attack Prevention

- Dynamic Reward Formulas

- Hosting Tournaments

- Referral Rewards

- eSports Federation

- Gamification Design

- Global Ranking

- Lessons and Mentorships

- Matchmaking Ranking

- User Reputation System

- Reputation Incentive

- Platform Design

- Applications UI/UX

- App Availability

- Desktop App

- App Architecture

- Security Audit

- Timeline

- Funding breakdown

- The Team

- Experience and Traction

- Members

- Joe Zhou | Project Lead, Dev

- Marco Cuesta | Head of Business Development

- Zack Coburn | Backend Dev, Smart Contract Architect

- Anik Dang | Frontend Developer

- Legal Counsel

- Daniel Temkin | Legal Counsel

- Advisors

- Joey Krug | Technical Advisor

- Mikko Ohtamaa | Technical Advisor

- George Popescu | Finance and Operations Advisor

- Disclaimer

Abstract

FirstBlood.io (“FirstBlood”) is an upcoming decentralized eSports gaming app that will allow individuals to test their skill and compete in 1v1 and team vs team matches for popular online games, such as League of Legends, Dota 2, and CounterStrike: Global Offensive.

Autonomous

FirstBlood’s innovations will allow skill based competition to take place independent of middlemen, such as financial institutions or casinos. The cryptocurrency Ethereum allows for the creation of smart contracts that run business logic autonomously in the blockchain. These smart contracts can be used for fast, secure and reliable processing of results and rewards from competitive eSports matchplays. Unlike existing platforms (which are both skill and game of chancebased), all of FirstBlood’s transactions are publicly verifiable, viewable, resistant to counterfeit, and not subject to the risk of institutional processing.

Decentralized

Traditional online businesses with centralized structures are subject to hacking, strict financial regulations, and onerous overhead costs. PeertoPeer (“P2P”) decentralization allows skill based competition without reliance on payment processors, reduces operational regulatory burdens, and protects against organizational corruption such as fraud and embezzlement.

Fully Automated

Each match outcome will be automatically verified by two groups: Witnesses, and/or the Jury Voting Pool (“JVP”). Witnesses are people running the automated Witness node software that verifies and reports game results. Payouts will be rewarded to the winner based on player reports and Witness checks. This significantly reduces the risk of fraudulent reporting that is rampant on similar platforms.

Market

Worldwide Digital Games Market, 2015E ($64.7B):

Organizing eSports tournaments is a key strategic component for top Multiplayer Online Battle Arena (“MOBA”) and FirstPerson Shooter (“FPS”) games, which have earned a combined $1.6B in revenues yeartodate.1 MOBA and FPS MMO (Massively Multiplayer Online) players spend more on gamingrelated expenditures than the average gamer,2, respectively. globally, converting Studios have into capitalizedpaying customers on this: thissince year Riot at begana rate officiallyof 7.7%

and 10.8%

sanctioning League of Legends tournaments in 2011, the game’s annual revenue has increased from $85.3M to a whopping $1.2B projected by year’s end.3

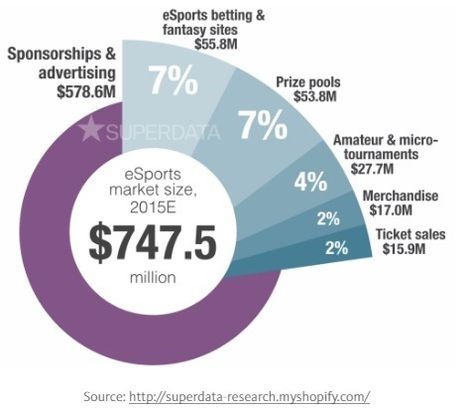

The global eSports market generated $748M in revenue in 2015E, and is expected to growthey continueto $1.9B toby rapidly2018E. investNorth inAmerica the space. and 4Europe One comprise 52% of the market as

American analyst even predicts that the eSports market in the U.S. alone will grow from $85M in 2014 to $1.2B in 2018, a compound annual growth rate of

American analyst even predicts that the eSports market in the U.S. alone will grow from $85M in 2014 to $1.2B in 2018, a compound annual growth rate of

93.8defined%.5 Theby SuperDatadefinition ofResearch the eSports6, includes market, theas

following categories:

- Sponsorships & advertising

- eSports betting & fantasy sites

- Major League Gaming prize pools

- Microtournaments

- Merchandise

- Ticket sales

SuperData Research, 2015. PDF.1 Llamas, Stephanie, and Ravon James. ESports_Market_Brief_Update_20152016_SuperData_Research. New York, New York:

23 Llamas, Stephanie, and Ravon James

Llamas, Stephanie, and Ravon James. 4 Llamas, Stephanie, and Ravon James.

- Lee, Paul, and Duncan Stewart. “ESports: Bigger and Smaller than You Think.” Http://www.deloitte.com/ . The Creative Studio at Deloitte, 2016. Web. 2016.

- Llamas, Stephanie, and Ravon James.

In 2015E, Betting & Fantasy sites, Prize pools and Tournaments revenues amounted to roughly $56M, $54M, and $28M respectively, totaling $138M, and is expected to grow to $350M by 2018E.7 This enormous growth potential presents FirstBlood with a compelling opportunity to capitalize on the growing interest of eSports enthusiasts who want to be more involved in the action.

A third of fans don’t just want to watch eSports, they also want to compete.8

On average, eSports fans compete in four live tournaments every six months.9 This can be inconvenient for frequent competitors. Likewise, nearly half of eSports enthusiasts bet on sports matches every week.10 They would like to be able to compete online through a trusted operator. Currently, there are only flawed solutions to the problem, and none support a seamless customer experience. Problems ranging from confusing userinterfaces (“UI”), to potential for fraud, have prevented current operators from reaching full potential.

FirstBlood’s decentralized online platform will provide an environment for gamers to compete without the problems associated with the current market offerings.

Opportunity

The global eSports market is growing prodigiously, with an expected compound annual growth rate (“CAGR”) of 37%.11 By 2018, the eSports market is expected to generate $1.92B in global revenue.12 Additionally, 33% of eSports fans don’t just want to watch, they also want to compete.13 Based on these figures, a market capture of merely 0.5% would produce an estimated $70,445,000 in platform volume for FirstBlood by 2018 just from competitive matchmaking.

78 Llamas, Stephanie, and Ravon James.

Souza, Emily. “The ESports Industry to Date.” https://newzoo.com . Newzoo, 2015. Web. 2016.

910 Llamas, Stephanie, and Ravon James.

Souza, Emily.

1112 Llamas, Stephanie, and Ravon James.

13 Llamas, Stephanie, and Ravon James. Llamas, Stephanie, and Ravon James.

Potential platform volume based on current data

| Game | Current Daily Players | Potential Volume[1] |

| League of Legends | 27,000,000 | $49,275,000 |

| Hearthstone | 10,000,000[2] | $18,250,000 |

| Dota II | 1,000,000 | $1,825,000 |

| CS:GO | 600,000[3] | $1,095,000 |

| Total | 38,600,000 | $70,445,000 |

The Solution

FirstBlood will be the first decentralized app, built on top of Ethereum, that allows eSports enthusiasts to compete in their favorite games through a decentralized, automated platform.

Through decentralization, participants are completely in control of their funds while using FirstBlood. The payments and payouts are made by the individual players and cleared on the Ethereum blockchain without ever being processed by a bank or any third party institution. This decentralized model reduces transaction and other operating costs. These savings will be passed on to the consumer, adding value that competitors cannot provide. Existing centralized solutions place consumers at risk. Players’ centralized accounts and deposits can be hacked, embezzled, or even confiscated with little recourse for those affected. With FirstBlood, users are completely in control of their assets with no involvement of third party institutions.

Smart contracts paired with a decentralized jury and witness system allow FirstBlood to operate in a unique way that has never existed before, and to be independent from game API policy changes. If a dispute arises that requires a higher level of scrutiny,

FirstBlood’s inhouse jury system will be activated to adjudicate.

Future Vision

FirstBlood aims to be the preferred global platform for skillbased eSports competitors and to play an essential part in shaping the future of blockchainbased projects. This project will initially focus on one gaming community, but will expand to include all of the major competitive eSports games. Ultimately, FirstBlood will be a leading brand in competitive eSports, affiliated with P2P gaming as well as influential regional and global tournaments. FirstBlood will also work with game developers by forming symbiotic relationships to enhance the gaming experience for all users. Doing so will encourage a higher level of participation on both parties’ platforms and bring cryptocurrencies and decentralized applications one step closer to mainstream.

Licensing

Due to transparent nature of smart contracts, much of the intellectual property will be open source.

App Token

FirstBlood Token (“1SŦ”) is an essential part of the FirstBlood ecosystem and economy. The four major utilities available to FirstBlood Token holders are:

- Playing matches

- Witnessing matches and voting on the jury

- Hosting tournaments

- Claiming rewards from referrals

Token Acquisition

As a utility token, 1SŦ is involved in every process of the ecosystem. 1SŦ can be acquired through FirstBlood’s native app, from another player via transfer, through playing competitive matches with players, from fulfilling jury duty or Witness duty after participants acquire 1SŦ, or from claiming referral rewards. Users will have the ability to acquire 1SŦ by sending Ether (“ETH”) to the 1SŦ creation contract on the blockchain during a presale. The FirstBlood interface will integrate third party trading solutions such as Shapeshift and Coinbase for users who don’t have ETH.

Token Presale

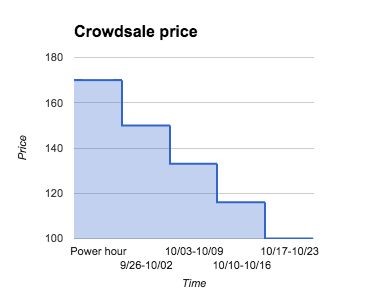

The FirstBlood Token initial distribution will be in the form of a presale. Anyone will be able to acquire 1SŦ at a discount rate by pledging ETH into the token sale smart contract. People who have other cryptocurrencies such as ETC, BTC or STEEM[4] can create 1SŦ via a thirdparty conversion service that will be available on the presale page. The sale will last four weeks from 9/26/2016 to 10/24/2016. These dates are approximate, as the actual start and end time will correspond to Ethereum block numbers.

The first hour of the sale will be a Power Hour. At this time, tokens will be available at a rate of 170 1SŦ to 1 ETH. Then the rate will change to 150 1SŦ to 1 ETH. Every week, the rate will decrease linearly until it hits 100

The first hour of the sale will be a Power Hour. At this time, tokens will be available at a rate of 170 1SŦ to 1 ETH. Then the rate will change to 150 1SŦ to 1 ETH. Every week, the rate will decrease linearly until it hits 100

1SŦ to 1 ETH.

The token sale will have a hard cap that, when reached, will immediately disable additional sales. The cap will be measured in Ether and set in the token sale smart contract to a value

approximately equal to $5.5 million USD based on the ETH/USD price at the start of the token sale.

At the end of the sale, the founding team will receive a 10% allocation of 1SŦ, subject to a twelve month holding period. These tokens will serve as longterm incentive for the FirstBlood founding team. An additional 5% will be allocated to an eSports ecosystem fund to be used for promotions and eSports tournament rewards. 2,500,000 1SŦ will be allocated to a FirstBlood bounty fund. The bounty fund will be used for presale marketing and bug bounties. At the end of the presale, token creation will be closed permanently. Token transfers will be restricted for two months after the sale ends.

Playing Matches

The FirstBlood platform is web and desktop software that allows users to interact with the FirstBlood smart contracts. 1SŦ can be used as stake in competitive eSports matches on the platform. Users will have the ability to send their stake to a smart contract that acts as a decentralized escrow. The smart contract handles the matchmaking and reward settlement after the match is processed by a decentralized result verification system.

The FirstBlood platform is web and desktop software that allows users to interact with the FirstBlood smart contracts. 1SŦ can be used as stake in competitive eSports matches on the platform. Users will have the ability to send their stake to a smart contract that acts as a decentralized escrow. The smart contract handles the matchmaking and reward settlement after the match is processed by a decentralized result verification system.

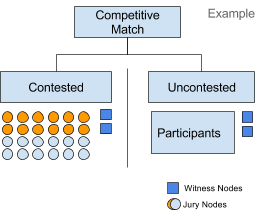

Match Result Verification

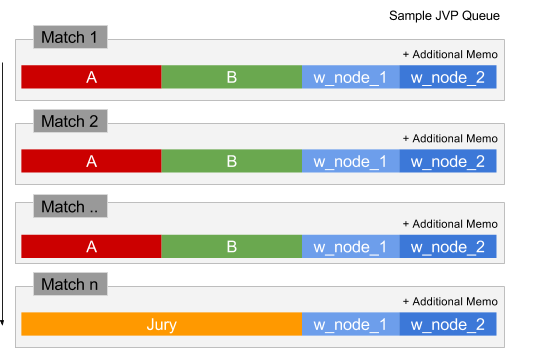

A decentralized result verification system is beneficial because it is resistant to game API policy changes, fraud from subjective reporting, and certain criminal activities. All 1SŦ holders have the right to help determine match outcomes by witnessing matches and voting in the JVP.

A match result can be either contested or uncontested. A match is contested if the opponents disagree about the result of the match. A match is uncontested if the opponents agree about the result of the match. Whether a match is contested or uncontested, it needs to be confirmed by two Witnesses.

Witnesses

A Witness is a special role in the match verification system. In order to act as a Witness, a 1SŦ holder must run automated Witness node software. Witness nodes are the curators of matches. They serve as the final gateway before matches and rewards are processed. The network of Witness nodes act as a decentralized proxy that has the ability to connect to game APIs and crossreference game outcomes to ensure no false, fraudulent, or suspicious matches are being processed by the platform.

In order to be part of the pool of possible Witnesses, 1SŦ holders need to opt in by sending a transaction to the smart contract. For each match, approximately two Witness nodes are chosen by a weighted random selection process and awarded 1SŦ for their services. Specifically, the Witness node software looks at each match assigned to it, checks game APIs for official results, and sends the results to the blockchain for all to see. The Witness node software is completely automated, thus, people running Witness node software do not need to intervene in any way.

A Witness’ probability of being selected will be proportional to his share of the total 1SŦ supply that has been optedin to the JVP. Specifically, 1SŦ share is calculated as

(user 1SŦ balance) / (opted_in 1SŦ supply). In order to do the random selection, the smart contract will provide a function that hashes a random seed provided by FirstBlood, the user’s address, and the match ID. The smart contract will use this hash to extract a random number from 0 to 1. The random number will then be scaled by the desired number of Witnesses. Finally, the random number will be compared to the user’s 1SŦ share. If the random number is less than the 1SŦ share, then the user is selected as a Witness.

Running a Witness node brings game result data into the system and helps protect the reputation and integrity of the platform. Witnesses provide a valuable service, and this is why they are rewarded with 1SŦ. Assume a Witness owns W%of the total (optedin) 1SŦ supply, the average Witness reward for each match is R, and the volume of the network is V per second. The Witness’ total hourly reward will be:

Hourly Reward = W * R * V * 3600 seconds

Let W = 0.5%, R = $0.125, V = 10 :

Hourly Reward = 0.5% * $0.125 * 10 * 3600 seconds = $22.5 or $200,880 annually

The potential incentive of running Witness nodes grows linearly with the network as more matches are needed to be processed in the queue. Thus, Witnesses have an incentive for the platform to succeed.

Jury Voting Pool

One of the perks of holding 1SŦ is the ability to receive compensation for fulfilling jury duty. In the event a match is contested, two Witnesses will be required. Some members of the JVP will be randomly selected as members of the jury. In order to be considered a member of the JVP, 1SŦ holders need to opt in by sending a transaction to the smart contract using the graphical user interface (GUI). All 1SŦ holders are recommended to be optedin so they can get rewarded by the system and so that the platform can better handle high match volume. Jury members will be selected by the same weighted random selection processes used for Witnesses.

If a member of the JVP has been selected to sit on a jury, that juror may submit one vote to influence the outcome of the dispute. The juror’s decision should be based on the results provided by the Witnesses, and any additional evidence or screenshots submitted by the players. FirstBlood will provide software to make it easy for players to provide evidence of their result. Once the desired quorum has been reached, the winner will receive the reward. For example, if one hundred people are selected in the JVP,

and the quorum is twenty, then twenty jurors must submit their vote before a case is considered resolved. A fraction of the reward will be paid to FirstBlood, and a fraction of the reward will be paid to the Witnesses and any jury members who voted with the majority. Members of the jury who voted with the minority may be penalized with a negative reward.

Sybil Attack Prevention

Because 1SŦ relies on a decentralized JVP to give rewards to the true winners, it is important to avoid corruption through Sybil Attacks by automatically created accounts. It would be harmful if one person used multiple accounts to get multiple seats on a jury. Likewise, it would be unfavorable if one group of users bought more 1SŦ than everyone else and managed to control juries by dominating the weighted selection process. FirstBlood has solutions for both of these cases:

- In order to opt in to the JVP, users must provide identity information such as first name, email or cell (could be activated for twofactor authentication (2FA)) to FirstBlood. This way, FirstBlood can ensure that each person has one unique account being used to participate in the JVP.

- While the probability of being selected for jury duty is proportional to number of tokens, this probability is capped at 1% per account. This way, FirstBlood can ensure no one is able to dominate the jury selection process. A user is free to purchase more than 1% of the token supply (for instance, to use in matches), but the probability will be capped at 1%.

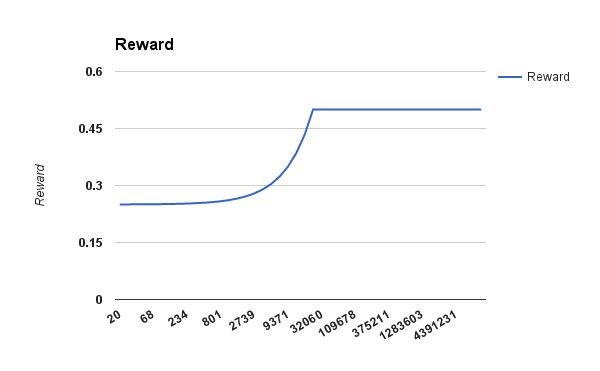

Dynamic Reward Formulas

The desired jury size, quorum size, rewards and penalties all may change as necessary. As they become available, FirstBlood will provide formulas so users can plan accordingly.

The desired jury size, quorum size, rewards and penalties all may change as necessary. As they become available, FirstBlood will provide formulas so users can plan accordingly.

For example, in order to ensure

FirstBlood’s ability to scale when more matches are being played at a given time, a Dynamic Reward Mechanism (“DRM”) will be implemented at the smart contract level. Rewards for running a Witness

node or voting accurately on a jury can vary dynamically based on how many cases are available versus the processing speed at a given time. Similar to a ridesharing app, with surge pricing to incentivize drivers, FirstBlood has its own floating reward structure. As match volume surges, so does the reward percentage for Witnesses and members of the JVP.

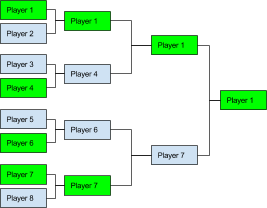

Hosting Tournaments

Another utility of 1SŦ is the ability to initiate tournaments on the platform. Tournaments can be competitive matches between individuals or teams. These tournaments can be an array of prearranged matches (bracketed, charity, freetoplay) handled by the same mechanism using JVP and Witness nodes. The 1SŦ tournament

Another utility of 1SŦ is the ability to initiate tournaments on the platform. Tournaments can be competitive matches between individuals or teams. These tournaments can be an array of prearranged matches (bracketed, charity, freetoplay) handled by the same mechanism using JVP and Witness nodes. The 1SŦ tournament

creation function will be one of the main pillars of the FirstBlood eSports ecosystem by attracting new users to become 1SŦ holders in the network.

Referral Rewards

Another way to acquire 1SŦ is by inviting friends to become active users on FirstBlood’s platform. Once

the friend has played his or her first competitive match on the platform, the referrer will earn a referral reward.

eSports Federation

The future vision for the FirstBlood Ecosystem extends far beyond our rewards platform. We aim for the FirstBlood token to be redeemable for goods and services within a partnered network of retailers, DAPPS, and other participants associated with FirstBlood. The team aims to be proactive in scouting synergetic projects that share the same values of innovation in the eSports industry.

Gamification Design

FirstBlood will implement a gamification element by introducing concepts like Global

Ranking (leaderboard style) and Matchmaking Ranking (“MMR”).

Global Ranking

A global ranking system will be viewable on FirstBlood’s platform to encourage competition among eSports players. Ranks will be awarded based on achievements such as special activities, “killing streaks”, and FirstBlood competition wins.

Lessons and Mentorships

Once a high enough rank is achieved by a player on the platform, the veteran player will be able to mentor lessexperienced players. The 1SŦ stake that is normally put up for a match will become payment for the lesson. This will allow the less experienced players to feel that they have the ability to succeed on the platform.

Matchmaking Ranking

A player’s Matchmaking Ranking (“MMR”) will be adjusted after every match. The MMR adjustment will depend on the current MMR of the player and the opponent. Winning a match can increase a player’s MMR by up to 39 points, while losing can decrease a player’s MMR by up to 39 points. The MMR gained or lost by one player in a match will be the opposite of the gain or loss of his opponent. Here is a sample formula:

var calcMMR = function(MMR1, MMR2){ var adjustment = (Number(MMR1) Number(MMR2)) / 20; var s1 = 20 Math.min(Math.max(adjustment, 19), 19); return [adjustment, s1];

};

User Reputation System

FirstBlood will have a User Reputation System (“URS”) to protect players, restrict hackers/criminals, and encourage healthy competition. This URS will be present in every aspect of the user experience, from initial signups to professional tournament play. Newlyjoined players will have to gain reputation to build trust in the community. The URS will incorporate public ranking with achievements to allow users to easily identify players who may have a history of abusing other players or hacking. This method could reduce abusive cases handled by the JVP. Likewise, the URS will enhance the competitive experience by encouraging players to level up and build reputation.

Reputation Incentive

FirstBlood’s URS can provide incentive for users to behave nicely and discourage toxic or malicious users from registering multiple accounts. The platform matchmaking engine (based on MMR) gives higher matching priority to users with higher reputation score. Each individual user will also have the ability to set the minimum reputation threshold for joining a specific match on the GUI level. Having a better reputation also allows users to play at higher levels with larger stakes.

Platform Design

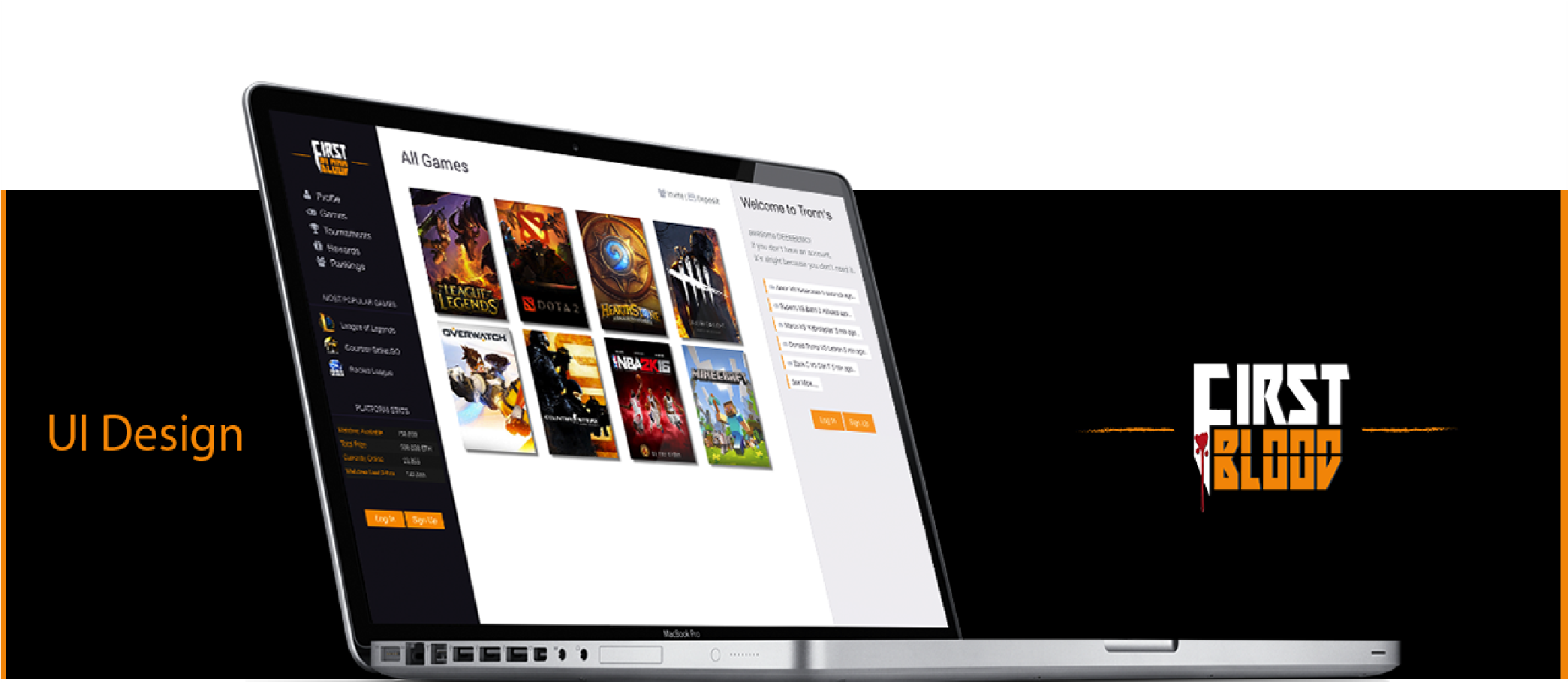

Applications UI/UX

Screenshot of FirstBlood prototype as of July, 2016.

FirstBlood is a platform for players to compete with each other and win rewards. FirstBlood is developing a unique application interface that propagates its branding and provides an easytonavigate user experience (UX).

The typical UX begins with registering a new account via the account creation process, followed by a guided tutorial of the platform, shown after the account is verified through email.

Representative available features on the user panel include:

- Basic Account Information

- Connected Games (Icons)

- Available Matches (Matches)

- Recent Matches (Results)

App Availability

Matches must be easy for users to join, making it essential to provide the interface on both web and mobile platforms. FirstBlood’s plans incorporate an agile crossplatform framework to reduce redundant work on specific OSfocused development.

Desktop App

FirstBlood plans to use an agile framework to create a native application that runs on players’ desktops. Electron[5], a framework for creating native applications with web technologies such as JavaScript, HTML, and CSS, could underpin a desktop application. This type of framework will enable the team to focus on the core of FirstBlood’s business. For example, Atom text editor, Slack desktop app, and Mist Wallet are some popular apps that are built using this framework.

App Architecture

- The user interface will be a single page app.

- The interface will allow the user to create an account by funding a new Ethereum address with Ether via an established payment processor.

- The user will then be able to create a username for this account, and the account information will be stored locally in browser storage (cookies). The user will be encouraged to write down the Ethereum account and private key as a backup.

- In order to encourage new users who aren’t familiar with Ethereum, FirstBlood will officially support MetaMask, a Chrome plugin that simplifies the process of getting an Ethereum account and allows users to avoid running an Ethereum node locally.

- FirstBlood will store certain important information related to its KYC[6] /AML[7] operation on a centralized database. User funds and game information will always be stored in the Ethereum blockchain, outside of FirstBlood control.

- FirstBlood will maintain a server to monitor the Ethereum events being emitted by the smart contracts via Geth. This server will keep track of statistics (top payouts, players, etc.) so that it can be viewed from the application without having to do heavy blockchain calls.

Security Audit

In order to ensure the safety of customer funds held in smart contracts, the FirstBlood team commits to subjecting its platform to a comprehensive security audit before launching on the Ethereum mainnet. In the past, Ethereumrelated projects have hired security consultants to conduct security audits prior to launch. FirstBlood will do the same with each updated version of the platform and will release the results prior to launch.

Timeline

Aug, 2016 : White Paper & Presale Announcement

Sep, 2016 : Crowdsale Starts

Oct, 2016 : Crowdsale Concludes

Dec, 2016 : Private Alpha among 1 SŦ holders, Alpha Community Tournaments

Jan, 2017 : Regional FirstBlood eSports Communities

Mar, 2017 : Private Beta

May, 2017 : Public Beta Release

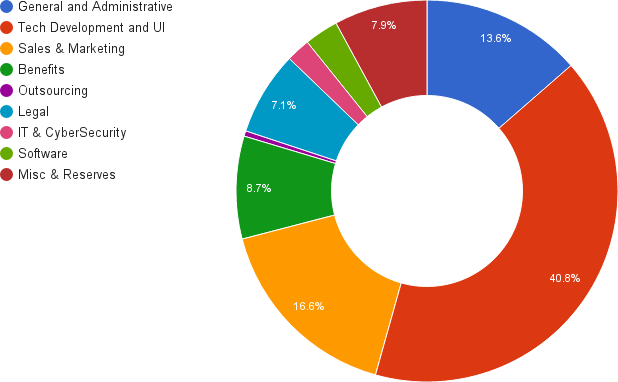

Funding breakdown

The Team

Experience and Traction

Core team members are proficient in multiple skills and speak multiple languages.

Members of the FirstBlood business team have expertise in multiple areas including compliance, business development, sales and marketing. In addition, all members have prior experience in either managing or working for startup companies.

Members of the development team also have experience in working on open source projects, such as Solome, which was a finalist for the Riot API Challenge, which provides 1v1 matchmaking and MMR tracking for the MOBA game League of Legends.

FirstBlood’s chief architect is the founder of Etheropt, the first decentralized options exchange for Ether. This project provided extensive experience in decentralized applications based on smart contracts and oracles in the blockchain.

Members

Joe Zhou | Project Lead, Dev

Joe is a derivatives trader and previously cofounder and CEO of AltOptions, a Boston based fintech startup. His most recent project is Solome, a solo matchmaking engine with the ability to autocheck game outcomes for League of Legends. He holds B.S.B.A in finance and entrepreneurship and he is an ACAMS chartered antimoney laundering specialist. He has experiences in building and leading startups and he’s also fluent in both English and Chinese. Joe is a Gold III League of Legends player and also plays popular FPS games such as CS:GO and Call of Duty: Modern Warfare 3.

Marco Cuesta | Head of Business Development

Marco previously cofounded AltOptions, a Boston based fintech startup. He holds a B.S.B.A in finance and strategy and trades cryptocurrency. He is a chartered ACAMS (certified antimoney laundering specialist). He also has practical experience in marketing and design from running his own production studio, Cuestam Productions. Marco plays a variety of FPSs but is most experienced with CS:GO and TF2 on the Steam gaming platform. Gamertag: OmnesOmni.

Zack Coburn | Backend Dev, Smart Contract Architect

Zack left a career as an options trader at a Chicago market making firm to be a fulltime entrepreneur. His most recent project is Etheropt, a decentralized options exchange built on Ethereum. Previously, Zack has founded or cofounded a variety of startups, including Chancecoin (altcoin for gambling), Subvert and Profit (social media marketing site), DormItem (college classifieds), and Madhens (ad auctions). Zack is an avid

Rocket League player and beginner at League of Legends. His favorite offline game is Death Note Mafia.

Anik Dang | Frontend Developer

Prior to FirstBlood, Anik worked at AltOptions building and maintaining frontend functionality of its derivative trading platform. His most recent project is Solome, a platform for matching 1v1 games and tracking solo MMR ratings. For this, Anik designed and implemented the matchmaking engine. He graduated Summa Cum Laude from Boston University with coursework in computer science focusing on algorithms and computational performance. Additionally, Anik possesses experience in both investment and corporate finance and is fluent in 3 languages: English, Russian, and Vietnamese. Anik is an avid gamer, reaching a Master Guardian Elite rank in CS:GO and has recently started playing League of Legends.

Legal Counsel

Daniel Temkin | Legal Counsel

Dan is an attorney licensed in New York, Massachusetts and before the United States Patent and Trademark Office. He has years of experience advising, mentoring and representing tech startups. Prior to beginning his legal career, he worked in sales and marketing roles at Procter & Gamble Co. Dan is an old school RTS gamer who still has a solid Castle time in Age of Empires II.

Advisors

Joey Krug | Technical Advisor

Joey attended Pomona College and discovered that his true calling was to design revolutionary systems on the blockchain. He is a core developer at Augur, a decentralized predictions market that raised over $5.3 million during its crowdfunding campaign. He is experienced in writing trading and consensus mechanisms on Ethereum contracts. Joey was also the first person to successfully conduct a Bitcoin transaction over sound. Most recently, the Thiel Foundation admitted Joey as a 2016 Thiel Fellow in recognition of his exceptional ability.

Mikko Ohtamaa | Technical Advisor

Mikko Ohtamaa is a blockchain entrepreneur having 15+ years experience in software and fintech industries. Mikko works for Revoltura, a Gibraltar based company in disruptive investment products. He regularly advises governments and financial institutions in blockchain matters. He is one of founders and former CTO of LocalBitcoins, the largest persontoperson Bitcoin exchange in the world. Mikko is also the sole creator of libertymusicstore.net, the largest Bitcoin music store in the world.

George Popescu | Finance and Operations Advisor

George is a serial entrepreneur who is experienced in all aspects of a startup company including finance, operations and marketing. He is the chairman of the Board of Advisors for Gatecoin, a blockchain asset exchange and also the founder and CEO of Lending Times, a media and affiliate marketing company in the peertopeer, marketplace and alternative lending space. He previously founded and exited Boston Technologies (BT) group, a technology, market maker, highfrequency trading and interbroker brokerdealer in the FX Spot, precious metals and CFDs space company. In 2011, BT was ranked #1 fastest growing company in Boston. George is Silver IV in League of Legends player, and also plays Witcher III, Total War series and many more strategy games.

Disclaimer

NOT AN OFFER TO SOLICIT SECURITIES AND

RISKS ASSOCIATED WITH 1SŦ AND THE FIRSTBLOOD NETWORK

Last Updated August 8th , 2016

This document is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities in FirstBlood or any related or associated company. Any such offer or solicitation will be made only by means of a confidential offering memorandum and in accordance with the terms of all applicable securities and other laws. None of the information or analyses presented are intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly this document does not constitute investment advice or counsel or solicitation for investment in any security. This document does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FirstBlood expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this document, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.

FirstBlood Token, or “1SŦ”, is a cryptographic token used by the FirstBlood network.

1SŦ is not a cryptocurrency.

At the time of this writing, 1SŦ (i) cannot be exchanged for goods or services, (ii) has no known uses outside the FirstBlood network, and (iii) cannot be traded on any known exchanges.

1SŦ is not an investment.

There is no guarantee – indeed there is no reason to believe – that the 1SŦ you purchase will increase in value. It may – and probably will at some point – decrease in value. Those who do not actually use their 1SŦ honestly and fairly will lose their 1SŦ to those who do.

1SŦ is not evidence of ownership or right to control.

Controlling 1SŦ does not grant its controller ownership or equity in FirstBlood, or the FirstBlood network. 1SŦ does not grant any right to participate in the control the direction or decisionmaking of FirstBlood or the FirstBlood Network.

- Risk of Losing Access to 1SŦ Due to Loss of Credentials

The purchaser’s 1SŦ may be associated with an FirstBlood account until they are distributed to the purchaser. The FirstBlood account can only be accessed with login credentials selected by the purchaser. The loss of these credentials will result in the loss of 1SŦ. Best practices dictate that

purchasers safely store credentials in one or more backup locations geographically separated from the working location.

- Risks Associated with the Ethereum Protocol

1SŦ and the FirstBlood network are based upon the Ethereum protocol. As such, any malfunction, unintended function or unexpected functioning of the Ethereum protocol may cause the FirstBlood network or 1SŦ to malfunction or function in an unexpected or unintended manner. Ether, the native unit of account of the Ethereum Protocol may itself lose value in ways similar to 1SŦ, and also other ways. More information about the Ethereum protocol is available at http://www.ethereum.org.

- Risks Associated with Voting

The purchaser may lose 1SŦ by exercising votes maliciously or carelessly.

- Risks Associated with Purchaser Credentials

Any third party that gains access to the purchaser’s login credentials or private keys may be able to dispose of the purchaser’s 1SŦ. To minimize this risk, the purchaser should guard against unauthorized access to their electronic devices.

- Risk of Unfavorable Regulatory Action in One or More Jurisdictions

Blockchain technologies have been the subject of scrutiny by various regulatory bodies around the world. The functioning of the FirstBlood network and 1SŦ could be impacted by one or more regulatory inquiries or actions, including but not limited to restrictions on the use or possession of digital tokens like 1SŦ, which could impede or limit the development of the FirstBlood network.

- Risk of Alternative, Unofficial FirstBlood Networks

Following the presale and the development of the initial version of the 1SŦ platform, it is possible that alternative networks could be established, which utilize the same open source code and open source protocol underlying the FirstBlood network. The official FirstBlood network may compete with these alternative, unofficial 1SŦbased networks, which could potentially negatively impact the FirstBlood network and 1SŦ.

- Risk of Insufficient Interest in the FirstBlood Network or Distributed Applications

It is possible that the FirstBlood network will not be used by a large number of businesses, individuals, and other organizations and that there will be limited public interest in the creation and development of distributed applications. Such a lack of interest could impact the development of the FirstBlood network and therefore the potential uses or value of 1SŦ.

- Risk that the FirstBlood Network, As Developed, Will Not Meet the Expectations of

Purchaser

The FirstBlood network is presently under development and may undergo significant changes before release. Any expectations regarding the form and functionality of 1SŦ or the FirstBlood network held by the purchaser may not be met upon release, for any number of reasons including a change in the design and implementation plans and execution of the FirstBlood network.

- Risk of Theft and Hacking

Hackers or other groups or organizations may attempt to interfere with the FirstBlood network or the availability of 1SŦ in any number of ways, including without limitation denial of service attacks, Sybil attacks, spoofing, smurfing, malware attacks, or consensusbased attacks.

- Risk of Security Weaknesses in the 1SŦ network Core Infrastructure Software

The FirstBlood network consists of opensource software that is itself based on opensource software. There is a risk that the FirstBlood team, or other third parties may intentionally or unintentionally introduce weaknesses or bugs into the core infrastructural elements of the FirstBlood network interfering with the use of or causing the loss of 1SŦ.

- Risk of Weaknesses or Exploitable Breakthroughs in the Field of Cryptography

Advances in cryptography, or technical advances such as the development of quantum computers, could present risks to cryptocurrencies and the FirstBlood platform, which could result in the theft or loss of 1SŦ.

- Risk of 1SŦ Mining Attacks

As with other decentralized cryptographic tokens and cryptocurrencies, the blockchain used for the FirstBlood network is susceptible to mining attacks, including but not limited to doublespend attacks, majority mining power attacks, “selfishmining” attacks, and race condition attacks. Any successful attacks present a risk to the FirstBlood network, expected proper execution and sequencing of FirstBlood markets, and expected proper execution and sequencing of Ethereum contract computations. Despite the efforts of the FirstBlood Team, the risk of known or novel mining attacks exists.

- Risk of Lack of Adoption or Use of the FirstBlood Network

While 1SŦ should not be viewed as an investment, it may have value over time. That value may be limited if the FirstBlood network lacks use and adoption. If this becomes the case, there may be few or no markets upon the launch of the platform, limiting the value of 1SŦ.

- Risk of an Illiquid Market for 1SŦ

There are currently no exchanges upon which 1SŦ might trade. If ever exchanges do develop, they will likely be relatively new and subject to poorlyunderstood regulatory oversight. They may therefore be more exposed to fraud and failure than established, regulated exchanges for other products. To the extent that the exchanges representing a substantial portion of the volume in 1SŦ trading are involved in fraud or experience security failures or other operational issues, such exchanges’ failures may result in a reduction in the value or liquidity of 1SŦ.

- Risk of Uninsured Losses

Unlike bank accounts or accounts at some other financial institutions, funds held using the FirstBlood or Ethereum network are generally uninsured. In the event of loss or loss of value, there is no public insurer, such as the F.D.I.C., or private insurer, to offer recourse to the purchaser.

- Risk of Dissolution of the FirstBlood Project

It is possible that, due to any number of reasons, including without limitation an unfavorable fluctuation in the value of Bitcoin, unfavorable fluctuation in the value of 1SŦ, the failure of business relationships, or competing intellectual property claims, the FirstBlood project may no longer be a viable business and may dissolve or fail to launch.

- Risk of Malfunction in the FirstBlood Network

It is possible that the FirstBlood network malfunctions in an unfavorable way, including but not limited to one that results in the loss of 1SŦ, or information concerning a market.

- Unanticipated Risks

Cryptocurrency and cryptographic tokens are a new and untested technology. In addition to the risks set forth here, there are risks that the FirstBlood team cannot anticipate. Risks may further materialize as unanticipated combinations or variations of the risks set forth here.

- Assumption: Daily players play 1 game daily. FirstBlood customer conversion = 0.5%; Average stake per game = $5; FirstBlood’s fee = 5.0%; Potential daily revenue = Daily Players * 20% * 0.5% * $5 * 5.0% ↑

- Assumption: 20% of total playerbase play daily ↑

- “CounterStrike: Global Offensive Steam Charts.” CounterStrike: Global Offensive Steam Charts . N.p., n.d. Web. 2016. ↑

- Both Steem and Steem Dollars (SBD) will be accepted. ↑

- Electron, a popular web framework for building native desktop applications. http://electron.atom.io/ ↑

- Know your customer (KYC) is the process of a business verifying the identity of its clients. The term is also used to refer to the bank regulation which governs these activities. ↑

- Antimoney laundering (AML) is a set of procedures, laws or regulations designed to stop the practice of generating income through illegal actions. ↑